And so to the engaging Nick Crafts on Industrialisation: Why Britain got there first (and mercifully not "Why someone else didn’t get somewhere they weren’t headed to begin with"). It’s an enjoyable talk replete with the latest findings of the scholar who with Knick Harley in 1982-83 gave us our first reliable (if even then slightly pessimistic) British industrialisation-era growth rates, for which we’d previously had only the estimates of Hoffmann and Deane & Cole – each similarly state-of-the-art in its day but relying on incomplete or inappropriate weighting or pricing.

Besides a welcome but guarded appreciation of Allen’s high-wage economy explanation (highly regarded hereabouts for all its lacunae) for Britain’s “take-off”, Crafts offers a likewise worthwhile though similarly sketchy grounding of British growth in long-run agricultural performance. Here it’s founded in enclosure (principally of the extra-parliamentary variety) – rather less satisfyingly than a more demand / output-sided approach – but he at least places the origins of Britain’s divergence well before the classical Industrial Revolution period.

There’s the obligatory nod to recent 1990-dollar estimates of past GDP, with 11th-century China this time at $1,244 (I’m not sure where that one came from, but it’s another to add to the mounting heap of similarly questionable extrapolations). But to his credit Crafts doesn’t make too much of the latest trendy figures beyond quite properly noting England’s early relative prosperity – even if it wasn’t quite of the magnitude of the estimates cited, so far as one can tell from any plausible guess at aggregate output.

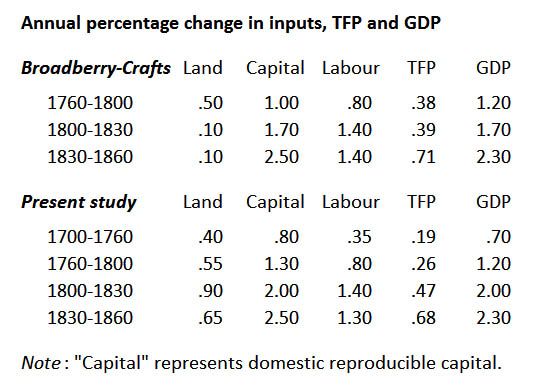

As probably the leading practitioner of 18th-19th century British growth accounting, Crafts makes great play of total factor productivity growth, the Solow residual or otherwise the famed “measure of our ignorance” – the differential between real output growth and the summed increment of capital and labour inputs, which he more or less equates here with technological advance.

The familiar conservative Crafts take on Industrial Revolution-era growth rates is on show, notably in his finding of annual growth in 1800-30 of a mere 1.7% in aggregate GDP and 0.3% in labour profuctivity, the latter half the increase suggested by my own output estimates (though his TFP growth rate is far closer - of which more later).

Poor Walt Rostow’s hypothesis of a compressed "take-off" stage receives short shrift, with Crafts echoing Deane & Cole in seeing his proposed investment rate increase as a longer matter than the putative 1783-1802 doubling period. For Rostow’s 10% level we’d indeed probably have to look to the 1820s, with the period between the Peace of Paris and the Treaty of Amiens yielding instead a rise in reproducible capital formation only from around 5 to under 7% of net national income (or from 7% to 9% or so for all assets including land), barely half the surge proposed in Rostow’s 1956 speculation (curiously, he was close with his 5% and 10% at the two dates - though unfortunately for different rates).

Crafts is in excellent company – notably that of Deane & Cole – in pointing to 1830-60 as the standout period of elevated investment. But in rejecting their excessive 19th-century output growth estimates (the result of deflating deficient contemporary current-price GNP estimates by Rousseaux’s over-volatile general price index) he errs too far in the opposite direction, replacing their finding of marked mid-century deceleration with one of a failure to realise corresponding productivity gains from the unprecedented investment rates of earlier decades.

It could be, of course, that the underlying capital data are themselves at fault, shaky as they are even in comparison to our necessarily limited GDP reconstructions. Certainly half of King’s 1688 grand total – his capitalisation of human labour – is omitted from modern definitions, as is the £300m of national debt counted in Beeke’s agggregate more than a century later. And the subsequent estimates of Pebrer for 1832 (itself merely a re-scaling of Colquhoun's of two decades earlier) and still more so Giffen for 1885 themselves look on the high side (chiefly owing to the value given for land) given a contemporary overall price level only marginally in excess of that of the last pre-WW1 years.

If that were the problem, however, one might expect the resulting discrepancies to be borne out by the figures. But if the answer lay in Beeke’s unadjusted estimate (the likeliest candidate from the rates offered), we should see a far higher capital growth rate before 1800, otherwise the implied 1760 capital stock is far too large unless we accept an anachronistic mid 19th-century valuation of land for a time well before the arable expansion and near-tripling of urban population of 1800-50.

Instead, it seems that Crafts has accepted needlessly pessimistic rates of capital formation overall, particularly for the 1800-30 period, for which a gloomier perspective is indeed borne out to some extent by his GDP growth assumptions. Where contemporary reckonings indicate something approaching a fivefold rise in the value of domestic capital (here including land) over the century to 1860, Crafts’s rates (and those of Feinstein and Broadberry on whom he draws) suggest something nearer threefold.

It could of course still be the case that contemporaries from King to Giffen and beyond got it badly wrong. But the onus here is on their putative challengers, none of whom have yet offered persuasive grounds for rejection of the broad sweep of the 18th- and 19th-century calculations. On the contrary, intervening revisions of British GDP tend to support a gradual fall in the total capital / output ratio from well over to under six times national income over the two-and-a-quarter centuries preceding World War 1. That’s a different matter to the precipitous drop implied by Crafts’s data.

So we’re left with the rates. And reconstructing their practical implications for the nation’s aggregate capital stock suggests gross understatement of growth of both land and reproducible capital. Indeed, it appears that estimators from Feinstein to Broadberry and Crafts (though not Deane & Cole, who sought meticulously to differentiate the two elements) have erred in applying a rate more appropriate to all domestic assets to reproducible capital alone. Couple that with an unfeasibly low growth rate for the land component itself, and it’s hardly surprising that there’s a problem. Crafts's reproducible capital growth rates – at least for 1760-1830 – lie well below those indicated by contemporary estimates of the resulting stock, even correcting for inflation over 1740-1815 and deflation thereafter. For that part of the national wealth we need to be thinking in terms of a yearly increase exceeding 1¼% in the late eighteenth century and 2% in the early nineteenth, otherwise we face an improbably high total at the start of the period or even steeper growth afterward.

And that's not all. To suggest that the real value of Great Britain’s land appreciated by only 3% over the whole of 1800-30 – a period when arable acreage rose by a fifth, pastoral acreage by perhaps a seventh, the stock of buildings (not included, but clearly relevant to nearby areas) by upwards of £150m, urban population almost twofold from 3.8 million to nearly 7.4m, and mineral output probably faster still – is clearly insupportable without a truly heroic initial assessment for undistinguished tracts of intrinsically far poorer eventually realisable worth. The finding is all the more puzzling when the more leisurely transformation of 1760-1800 is reckoned to have had five times the annual impact.

Land valuation for growth-accounting purposes may well be an insuperable difficulty. The contemporary valuations between them give a clear impression that it was increasing (far more rapidly than the area in productive use) over the two centuries to Giffen's 1875 estimate, and falling thereafter until around 1930. In fact the total appears strongly correlated with aggregate agricultural output, as might indeed be inferred from the link between productive capacity, rental value and purchase price. The latter approach appears unavoidable if we are pricing capital according to its cost, and has the benefit of reflecting current-price capital / output ratios.

The upshot of the prevailing underestimation of capital growth is to greatly overstate TFP's 18th-century contribution: that Crafts is right in the 19th only arises from the happy combination of understatement of both capital and output growth coupled with an improbably high labour input rise in the last period. The apparent stagnation of labour productivity and TFP change in 1800-30 appears to reflect improbably low GDP growth and earlier understatement of capital input.

One finding that these reworkings support is the decline in the share of TFP's growth contribution to 1830, or rather c.1800. This is problematical for TFP as an indicator of technological progress, as neither the 18th century nor still less the period 1760-1830 stands out as a time of relative technological sluggishness. What we may be picking up here is an echo of the commercial disruptions occasioned by Britain’s long intermittent struggle with France: if so it’s a reminder that as a residual, the measure may incorporate a range of intangibles, not least the wider trading context.

No comments:

Post a Comment